Looking Ahead to 2018 -- Part 3

I was going to start by looking at the property markets in the

major countries but I donít think that will help anyone. Letís

look at things in a different way.First, do remember, investing in real estate in a country is equivalent to investing in the country itself. Would you invest in a bankrupt company? Of course you wouldnít, so why invest in a bankrupt country?

Admittedly there is a strong argument for claiming that the UK is also bankrupt, but if you take that view, then perhaps you should invest in a country that is less bankrupt than the UK, not one that is more bankrupt.

Using that metric, anyone who invests in Portugal, Spain, France, Italy, Greece, and maybe a couple of other countries is investing in a country that is financially worse off than the UK. Leave all those countries well alone.

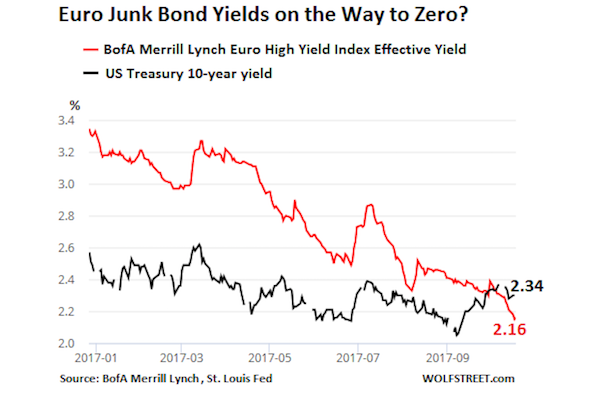

Let me add to that generality. Have you checked out Euro Junk Bonds recently? A junk bond is one that is invested in companies which are below investment grade. In short, they are speculative, and they are not the kind of bonds you should invest in for your pension. More practically, the companies that such bonds are invested in have a good chance of going bust within the short term. In usual times these bonds carry high value coupons, meaning you get a high rate of interest in return for your investment. That high rate is supposed to compensate you for the risk you are taking in investing in low grade companies. Now look at the chart below. Low grade EU company bonds are paying less than US Treasury Bonds, which are supposed to be the safest on the planet. As the Americans like to say ďGo figureĒ.

The EU economic system is held up by pure insanity. We already know that the EUís share of world trade has dropped ferociously over the lifetime of the EU political system, and is still tanking. But letís home in on a couple of individual countries.

I will try and find an updated map of the cross landings and therefore the contingent damage that hang on the various major EU banks. My one is five years old, and the situation has worsened considerably since then. (Unfortunately I cant find an updated chart.) One of the most heavily indebted in terms of contingent damage is the French banking system. They have lent considerable sums to Greek and Italian banks which are unlikely to ever be paid back. That makes the French banking system liable to collapse. That makes the lending situation in France a dangerous one. That will of itself impact upon any private lending and therefore upon house prices.

There is also the problem of political tension in Greece and Italy, but Iíll come back to the politics later.

Greece has been financially castrated. Just look at this chart to show how the Greek economy has benefited from the EU. This is hardly what might be called a success story. Anyone who invests in Greece is a mug.

Spainís economic figures are still not good. Portugal is in the same category. Both these countries have several problems in common. Neither country can balance its budget, and both countries are falling behind in the economic ratings. I understand that when Britain leaves the EU that will tear in big hole in the unionís bank balance. It is estimated that Spain will be roughly Ä39 billion out of pocket as a result. There will be worse to come if there is no agreement about cross-border travel, as this will impact quite seriously on the tourist trade for both countries. Both have a large preponderance of UK citizens resident in the south of these countries. There is a strong likelihood that many pensioners will be forced to return to the UK simply because of health care considerations.

Of course, I don't know what the final deal will look like, and I strongly suspect most of the talk at present is mere posturing, and common sense will prevail at the last minute simply for plain economic necessity, but we are talking about politicians, and none of them seem very bright. It is a risk.

We currently have half of the continent in political turmoil. The UK has a hung parliament, so does Germany. France's latest president has had his popularity cut, Austria is making rude noises about the currency union, so is the Czech Republic, and the Italian elections are due shortly, with the outcome there looking as though it will lead to more chaos.

With the EU in such turmoil I think the best way forward is to stay put, or invest in the east. The call used to be "Go West, young man." Nowadays, the best deals look to be in the east.

I don't expect many of my readers to be interested in investing in South-East Asia, but I shall be heading in that direction to see what things are like. Unfortunately, at the moment I am housebound due to a silly accident in a neighbour's swimming pool as a result of which I have one leg in a cast and one hand bandaged. I shant be going anywhere until I get my limbs back. When I do I will, of course, report back. In the meantime I still think the EU is a no-go area.

Next week I will have a brief look at conditions in the UK.

|

Subscribe

to our email alerts on the housing markets both

in the UK and abroad.

|

HTML Comment Box is

loading comments...

Podcasts: