House Prices Rise -- The Auction Index

I was recently pointed in the direction of auctions from several different sources. First, I noted that the auction houses were full to brimming with properties for sale after a somewhat lean year last year. That could have been a result of slow sales, with people turning to the auction house in desperation. That turned out not to be the case as I will show you in a moment.

Then there was the news that house prices were rising and the newspapers were full of the news that people like me were being proved wrong, and house prices were set to boom. After over forty years of being right year after year that came as a rather amusing eyebrow raiser. House prices about to go through the roof when mortgage lending was constrained, and incomes were declining? Someone's got to be joking, haven't they?

Then I heard of a seminar about buying properties at auction. This was supposed to be the new way to buy properties because that's where the bargains were. So I had to check this out.

For those of you who haven't been following my writings for very long I need to explain that when I was a kid at university I started producing various reference tools to help me understand how housing markets worked. I was always interested in real estate, and also in maths, and this led me to start creating a series of tools to help understand how housing prices moved.

One of the tools I developed was the auction index. This was meant to be a predictive tool. Too many analysis tools are historical, they show what has happened, not necessarily what will happen. Part of the raison d'être of the auction index was to show what would be happening in the main market a few months down the road. Auctions are fast track sales mechanisms, and the turn-round time is usually four to six weeks. The more traditional sales mechanisms take three to four months, so if I could work out what was happening in the auction room I would have an idea what was about to happen in the wider market.

I worked out a tool for analysing the data I had, and I structured it so that I could tell whether the market was under-valued, fairly valued, or over-bought.

The system I used produced a set of numbers. The numbers 0-10 showed an under-valued market; 11-20 showed a fairly valued market; 21-30 showed an overbought market; and any figure above 30 showed a market that was dangerously over-valued and unsustainable.

I have not been producing an auction index recently because the housing market has been in the doldrums, and that has been obvious to anyone. However, with the latest protestations that the market was about to surge forward I had to check the figures.

My opinion is that estate agents and pundits are talking their book.

The housing market is moved by the availability of money, nothing else. Money is not increasingly available so markets should not rise appreciably. The affordability index (something else I invented during my late teens) also shows that house prices are close to their highest comfortable range. So what does the auction index show?

I must admit to being rocked to my boots at the results, so much so, that I back-traced them six months. Here are the results.

| London | 26.9 |

Overbought |

| South England | 31.34 | Unsustainable |

| South West |

25.55 | Overbought |

| East Anglia | 27.58 |

Overbought |

| Midlands | 49.79 |

Unsustainable |

| Wales | 20.8 |

Overbought |

| North England | 25.52 | Overbought |

The figure for auction houses covering the whole of the country is 26.9, which again is well into overbought territory.

For a country which is teetering on the edge of recession these figures are absurdly high.

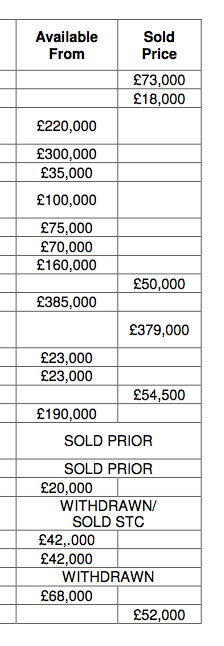

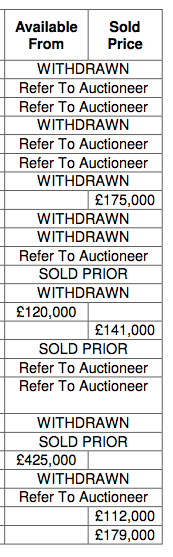

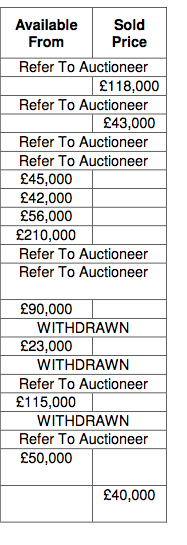

What I have noticed is that some auction houses are experiencing exceptionally high levels of price rejection. There are cases where auctions are experiencing half, or even two thirds, of the houses offered not reaching their reserve price.

My conclusion is that prices have to fall back. This mini-boom we are being told about must end in tears. Now is most definitely not the time to start investing in UK real estate.

Just look at these excerpts from some auction results charts. More than half the houses simply aren't selling. One auctioneer is trumpeting a great result, "another outstanding day", when over 45% of the properties on offer didn't sell.

|

|

|

I think we need to relax and take another dose of reality.

john

|

Subscribe to our

email alerts on the housing markets both in the UK and abroad.

|

HTML

Comment Box is loading comments...

Podcasts: