The German Property Market

There are a lot of things wrong with the

EU, but one of the main problems is the concept that one

type of economy fits twenty odd different countries. Anyone

with a modicum of common sense will realise that you can't

squeeze twenty countries into one economic system.

In the recent past you had low interest rates across the currency zone which led to painful boom and bust situations in Ireland, Spain, and Portugal. All those countries needed higher interest rates. Germany, on the other hand, was going through a rough patch after having absorbed East Germany. They wanted lower rates. Germany had more clout; they got their lower rates.

Now things are the other way round. Germany is booming and could do with higher interest rates, while Spain, Portugal, Italy and Greece, and probably other countries as well, could do with leaving rates on the floor.

It's a recipe for long term disaster. But it is also a recipe for opportunity.

Let's have a look at a few basic facts and then try to draw some conclusions.

The idea of monetary policy is to smooth the business cycle. If the economy is week it can be given a kick-start with lower borrowing costs. Booms can be slowed by having a tighter policy with higher interest rates. The trouble is, if twenty-odd countries all have independent cycles, they are going to be at different stages in the cycle, and therefore a common interest rate for them all will probably mean that not a single economy is functioning on the optimum rate at any particular time.

It isn't much good to set an average rate. This pleases no-one. In fact, the way things are, the whole area can never be happy at the same time.

The ECB can't raise interest rates at the moment for fear of making things even worse for Italy and Greece, and probably Spain as well, so rates remain low. On the other hand, Germany's economy is on a tear, and the rates should be much higher there. Instead, the country is booming, and the country's property market is booming too.

The interesting question posed in an article I recently read was: what would happen if the German property market caught up with US prices, or even UK prices?

The figures came out like this. For a US price equivalence, €24 trillion extra wealth would be created. That is a huge increase. The figure is almost off the scale for a UK equivalence: up by €73 trillion.

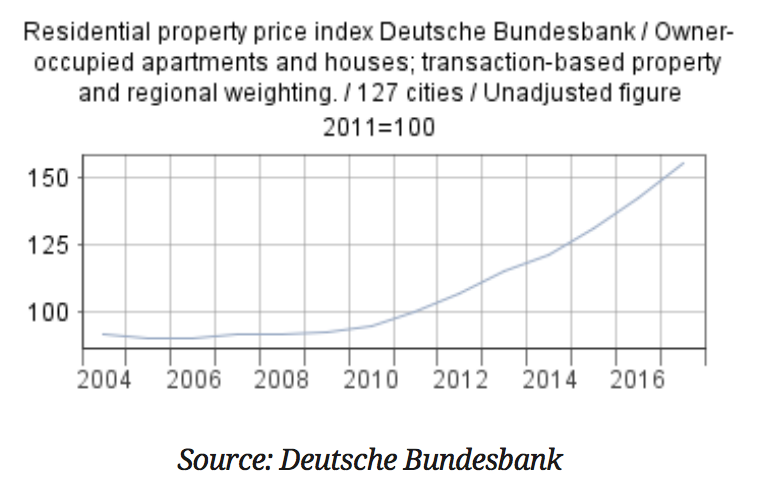

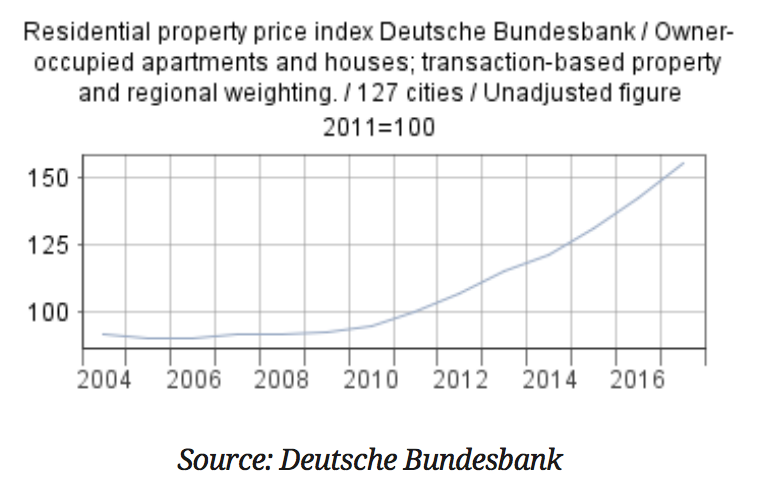

So far, prices in Germany are rising. The housing market is at the beginning of a boom, and this is going to lead to a great increase in the wealth of those holding real estate.

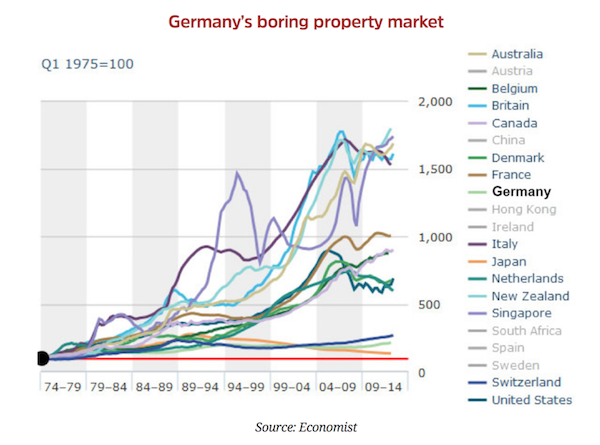

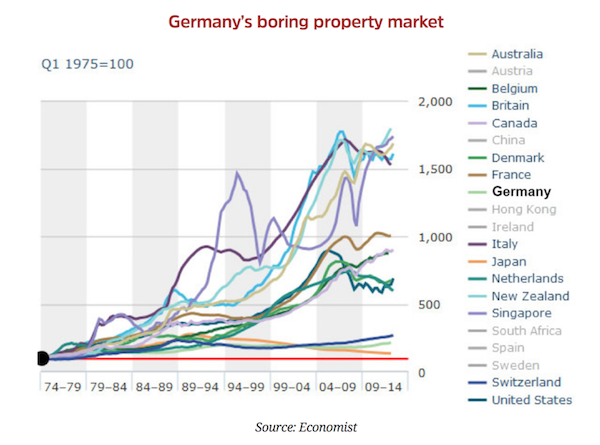

If we look at a chart of a selection of house prices over the last few decades we can see that the German market has hardly moved. Of course, maybe it never will, but if it does, it has a heck of a lot of catching up to do.

Germany's home ownership rate is way down the list as well at just over 43%. The UK level is a tad over 71%.

According to a report from property consultancy Knight Frank, property prices in Berlin soared by nearly 21% last year, putting it the top of the 150 world cites it surveyed. The German cities of Hamburg, Munich, and Frankfurt all experienced price growth of between 13 and 15% too, putting them in the top 10.

The fact that residential property in Berlin is still affordable compared to, say, New York or London, has encouraged an influx of foreign investors— including Warren Buffett, who last month inked a franchise deal with Berlin-based luxury apartment company Rubina Real Estate.

Vacancy rates in German cities are absurdly low – near 0% for Munich, Frankfurt and Hamburg according to Deutsche Bank.

Probably the easiest way into this market short of buying property yourself would be to invest in a German REIT.

Real estate investment trusts, or REITs, are a means of gaining investment exposure to real estate without actually going out and buying bricks and mortar.

A couple of year's ago I was going to recommend people buy into a German company that buys up listed buildings in Berlin, renovates them, and rents them out. It's doing well, but I am not in the business of giving investment tips. All I will do now is suggest it might be a good idea to check out some of the German REITS. There are a couple listed on the London Stock Exchange. You'd be buying for the boom, and maybe getting out before the bust so you don't get stuck with the underlying asset if it's value goes down again.

If you are buying into real estate for investment purposes this is probably the least risky way in. But, as I said at the beginning of this short series of blogs, when buying real estate don't confuse matters. If you are going to buy for yourself, you make the same decision abroad that you would make in the UK. That first decision is based on carefully thought out pros and cons concerning the suitability of the property and place for your life style. As investment guru Bob Beckman used to say: remember your home is your nest, not your nest egg.

In the recent past you had low interest rates across the currency zone which led to painful boom and bust situations in Ireland, Spain, and Portugal. All those countries needed higher interest rates. Germany, on the other hand, was going through a rough patch after having absorbed East Germany. They wanted lower rates. Germany had more clout; they got their lower rates.

Now things are the other way round. Germany is booming and could do with higher interest rates, while Spain, Portugal, Italy and Greece, and probably other countries as well, could do with leaving rates on the floor.

It's a recipe for long term disaster. But it is also a recipe for opportunity.

Let's have a look at a few basic facts and then try to draw some conclusions.

The idea of monetary policy is to smooth the business cycle. If the economy is week it can be given a kick-start with lower borrowing costs. Booms can be slowed by having a tighter policy with higher interest rates. The trouble is, if twenty-odd countries all have independent cycles, they are going to be at different stages in the cycle, and therefore a common interest rate for them all will probably mean that not a single economy is functioning on the optimum rate at any particular time.

It isn't much good to set an average rate. This pleases no-one. In fact, the way things are, the whole area can never be happy at the same time.

The ECB can't raise interest rates at the moment for fear of making things even worse for Italy and Greece, and probably Spain as well, so rates remain low. On the other hand, Germany's economy is on a tear, and the rates should be much higher there. Instead, the country is booming, and the country's property market is booming too.

The interesting question posed in an article I recently read was: what would happen if the German property market caught up with US prices, or even UK prices?

The figures came out like this. For a US price equivalence, €24 trillion extra wealth would be created. That is a huge increase. The figure is almost off the scale for a UK equivalence: up by €73 trillion.

So far, prices in Germany are rising. The housing market is at the beginning of a boom, and this is going to lead to a great increase in the wealth of those holding real estate.

If we look at a chart of a selection of house prices over the last few decades we can see that the German market has hardly moved. Of course, maybe it never will, but if it does, it has a heck of a lot of catching up to do.

Germany's home ownership rate is way down the list as well at just over 43%. The UK level is a tad over 71%.

According to a report from property consultancy Knight Frank, property prices in Berlin soared by nearly 21% last year, putting it the top of the 150 world cites it surveyed. The German cities of Hamburg, Munich, and Frankfurt all experienced price growth of between 13 and 15% too, putting them in the top 10.

The fact that residential property in Berlin is still affordable compared to, say, New York or London, has encouraged an influx of foreign investors— including Warren Buffett, who last month inked a franchise deal with Berlin-based luxury apartment company Rubina Real Estate.

Vacancy rates in German cities are absurdly low – near 0% for Munich, Frankfurt and Hamburg according to Deutsche Bank.

Probably the easiest way into this market short of buying property yourself would be to invest in a German REIT.

Real estate investment trusts, or REITs, are a means of gaining investment exposure to real estate without actually going out and buying bricks and mortar.

A couple of year's ago I was going to recommend people buy into a German company that buys up listed buildings in Berlin, renovates them, and rents them out. It's doing well, but I am not in the business of giving investment tips. All I will do now is suggest it might be a good idea to check out some of the German REITS. There are a couple listed on the London Stock Exchange. You'd be buying for the boom, and maybe getting out before the bust so you don't get stuck with the underlying asset if it's value goes down again.

If you are buying into real estate for investment purposes this is probably the least risky way in. But, as I said at the beginning of this short series of blogs, when buying real estate don't confuse matters. If you are going to buy for yourself, you make the same decision abroad that you would make in the UK. That first decision is based on carefully thought out pros and cons concerning the suitability of the property and place for your life style. As investment guru Bob Beckman used to say: remember your home is your nest, not your nest egg.

|

Subscribe

to our email alerts on the housing markets both

in the UK and abroad.

|

HTML Comment Box is

loading comments...

Podcasts: