The Unique Property

Site Blog

2021 -- Part Seven -- The Auction Index

Last week we started going through our list of important indicators that hopefully will help us understand the housing market. We have already mentioned the Affordability Index, and the Rent to Mortgage Costs Ratio. Both of these are really important indicators, but we have a few more to look at.

The next on the list is the House Price Index. You can keep abreast of this by checking the Nationwide index. From this it appears that house prices have risen over the past year by about 5%.

My own view is that, on its own, the index tells us very little. After all, it is a lagging indicator. That's not much good if you want to look into the future. House prices may rise, or they may fall, but the important issue is to track this indicator against other indicators. If house prices rise when wages don't, or when wages fall, then you can expect prices to stall or fall in the future. If prices rise roughly in tandem then the market is stable. If wages take off, then house prices may well follow.

At the time of writing (December 2020) UK wages are rising at approximately 2.7% p.a. This figure needs to be adjusted for inflation, and since inflation for the same period comes in at 1.8%, average earnings will have effectively increased by only 0.9%.

Now we have to do another calculation. House prices have risen by approximately 5%, while wages have risen by almost 1%. It doesn't take a mathematical genius to work out that house prices are rising faster than wages. It also doesn't take a genius to work out that means house prices are heading towards unsustainable levels. The affordability of the average house for the average person has risen and is still rising.

Under normal circumstances we would set that against the economic carnage that politicians are inflicting on economies around the world on the excuse of covid-19 measures. In other words the outlook for house prices in the medium term is for any rises to be temporary. That means that buying a house right now could be a mistake.

In the previous video we spent some time discussing the Rent to Mortgage Costs Ratio. I gave a brief explanation of how to calculate that ratio, but also pointed out that the figures must of necessity be very local so that is not something I can put figures on at the moment.

Our next index is another that I invented myself, the Auction Index.

I find it works very well in a rising market but is not so useful in a falling market. The reason for this is simple. It will clearly tell you when prices are too high (although it does not predict a top). That is a useful warning to people to ease off on the buying activity. In a falling market one shouldn't be buying anyway, so the warning is not really necessary. However I do like to do a calculation maybe once or twice a year in a falling market just to see if any changes are taking place that I wouldn't otherwise notice.

For the record, you have to know that on the index a figure between one and ten means that prices are low and therefore sales are high, and are probably poised to rise. In other words this would normally be a buy signal. A figure between eleven and twenty means the market is roughly in equilibrium. Figures over twenty show that prices are too high which is why many properties are failing to sell. A figure above thirty would indicate absurd price levels, and would indicate that anyone buying is paying way over the odds.

What these figures indicate is that when people are buying and the index is low, buyers are having no difficulty in raising the necessary funds, whereas when the index is high, rather a lot of properties are left on the books, presumably because potential buyers are in short supply, and that indicates that prospective purchasers are baulking at the prices which simply means they are too high.

Another reason to follow auction prices is that they are a forward indicator. Typically completion takes place within four weeks of the auction date. Normally, house completions can take anything from 3/4 months, which means auction prices are a little ahead of the game.

The index is worked out very easily. You take an auction and discover what percentage of properties fail to sell. If they sell before the auction date, or closely afterwards then those sales would be classed as being part of the auction. Any sale taking place a week or more after the close of the auction would be disqualified.

If there are 200 lots in the auction and 178 of them sell on the day, then 22 have failed to sell. In short 11% of the lots did not sell. The index is therefore 11. If there were 150 lots and 30 failed to sell, then the index would be 20. It's as easy as that.

The theory behind the scale is simply that the more lots that fail to sell the more prices are deemed to be unacceptable. If all lots sell then prices obviously have room to move up. Once the ratio of unsold lots goes above 20 it means that an increasingly significant number of lots are seen to be over-priced. It doesn't indicate that prices will fall, but it does indicate there is price resistance, and that in itself shows that some people are paying more than they should for properties. Putting it another way, the higher the index, the less good deals there are. No professional buyer should be buying with the index over 20 unless there is an anomaly in the list of lots.

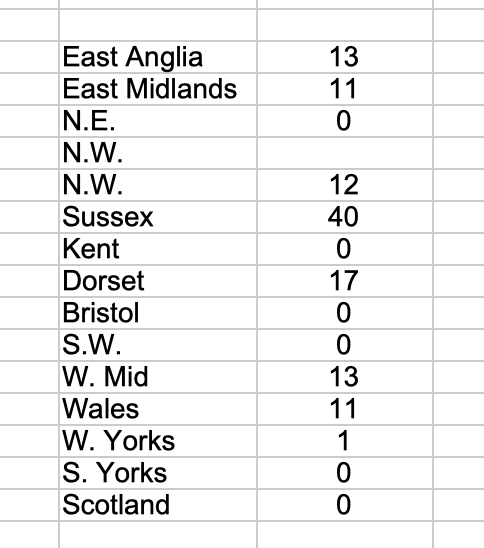

Let's have a look at some recent auctions and see where the figures lie.

The figures are all over the place. Did anyone expect anything else in the messy environment in which we live? The lowest figure I have is 1. That is in the South. The highest is 56, which is a figure for an auction covering the whole country. Why so high? Several auction houses are having properties pulled from the list. The obvious conclusion is that some folks are nervous, and I dont blame them.

If I pull out the properties that have been withdrawn from sale I get a different picture. There are several regions where the figure is zero, which means there is no evidence at all of over-pricing. There are several markets in the teens, which is healthy. In fact there is only one area where prices are way too high, and that is in Sussex. (Hmmm, what on earth possessed me to sell all my South Coast properties?) These figures are for December only.

Finally we need to look at the state of the mortgage market. At the moment with lockdowns in place, businesses forcibly closed, a sudden increase in the unemployment figures, rent and mortgage holidays, and so on, you can take it that anyone lending money on house purchases has to be a foolish optimist.

First, why lend to someone who might be added to the unemployment figures in a month or so's time? Why lend to someone who may need a payments holiday? Why take a risk on house prices holding up in the face of the economic woes?

The longer this pandemic continues, the more likely mortgage companies will look to retrench. The lending environment has to be close to panic stations.

So where does this leave us with regard to the state of the housing market? Next week we'll tot up the damage and come up with some conclusions. Until then, stay safe and keep the home fires burning.

|

Subscribe

to our email alerts on the housing markets both

in the UK and abroad.

|