The Unique Property

Site Blog

Crash Alert 2

A couple of weeks ago I wrote about the problem with house prices. We are in an inflationary period and this means the value of money is decreasing, which makes everything cost more.There are also those supply chain problems. And they are hurting most economies. Important in this respect are the fuel cockups and the grain cockups. I will talk about these next week, but at the moment Canada is deliberately preventing gas from reaching Germany by refusing to repair an essential item in the supply chain. The argument here is interesting but I'll cover that next week.

Grain is being prevented from leaving Ukraine by the Ukraine government. Understandable in one sense, they might need it if this year's grain harvest is interrupted, but dont they need the money?

Yes, it's all a mess. But today's issue is interest rates. the UK and USA are both raising them which will cause trouble with mortgage payments, and make the cost of a house more expensive, likely causing a fall in purchases and a reduction in prices.

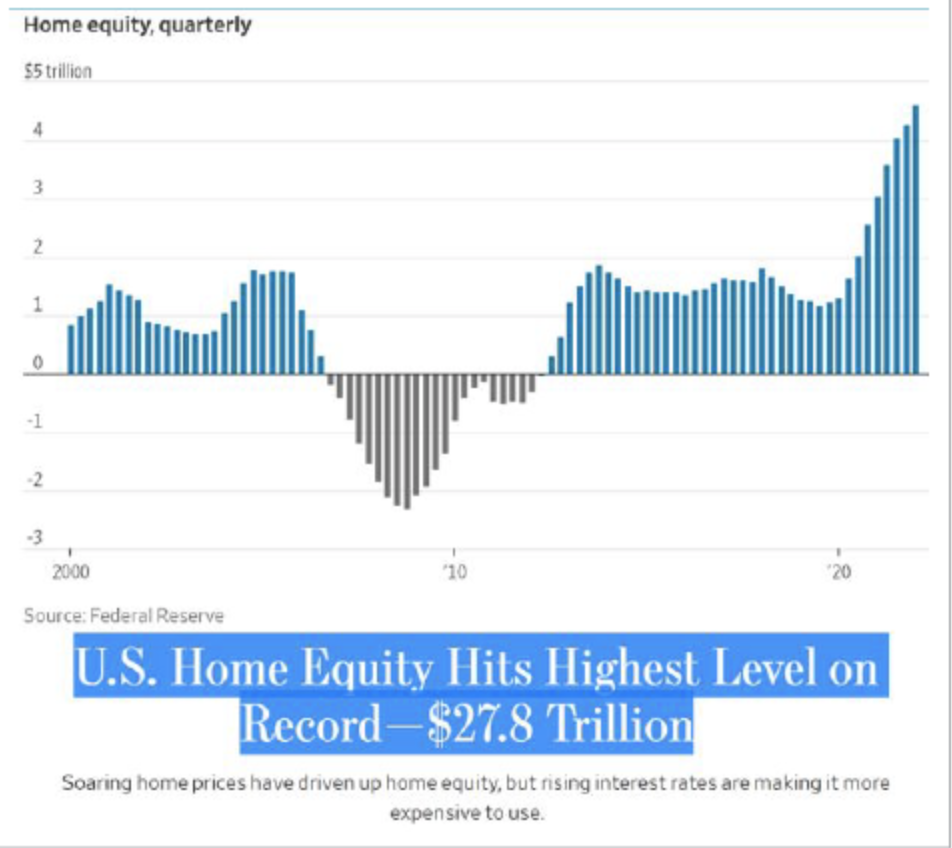

Here's a chart showing US house price rises. Parabolic, and at an all-time high.

With rampant inflation (in reality well into double figures) people's pockets are empty, and as house prices fall, they are going to feel emptier.

And, as I said a couple of weeks ago, The S&P CoreLogic Case-Shiller U.S. National Home Price Index shows that home prices there are up 34% over the past two years. Homes are becoming less affordable at an unprecedented pace.

If you are thinking of moving, I suggest selling now, and renting for a while, and buying later. Now is not the time to buy.

In EU things are slightly different. the European Central Bank is not raising rates. But we do have the problem mentioned above. Clearly there is a concerted effort to wreck the EU, and the threat is not coming from Russia, but apparently from a bunch of English speaking countries. What is going on? I don't pretend to know, but I will home in on the subject next week. In the meantime just beware. All is not well in the real estate markets, and there are some very perplexing moves being made which need careful thought.

|

Subscribe

to our email alerts on the housing markets both

in the UK and abroad.

|