House Prices

in 2013 - Part 2

This is my second scenario for the new year. I am assuming that the inevitable happens: the floor collapses.

Let's face it, almost every country in the eurozone, together with the UK, is broke. That's nothing new, but what is new, is that everyone is broke together. We might as well all hold hands, sing lustily into the night, finish up the champagne, and collapse together. I shall revisit this apparently flippant situation in scenario three.

Maybe Norway is not broke. Maybe life in southern Albania is sweet, who knows? Maybe the tooth fairy will come up with something. Maybe Santa has a solution in his sack. Maybe…..

Hold on. Let's look at the facts. Ireland, Portugal, Spain, Greece, are all on a life support system. They are not only broke, but they are receiving loans from other countries which are either broke themselves, or close to it. Let's be sensible. Since when did you lend money to a down and out and expect to get it back? Since when could you expect someone who is broke to lend you money?

Reality says the money given to the PIGS wont be coming back. It is money that is going down the drain. It is wealth that is vanishing.

Let's look at another little image. Your next door neighbour is broke. He owes money on his mortgage. His house was bought for £300,000. It is now worth £200,000. He has a mortgage for £250,000 and he's two months late with the payments. What happens if you lend him money? It goes into a hole. You wont see it again, he wont see it again, and it wont ever pay off the existing debt. That debt ultimately has to be written off. The more money you throw down that debt hole the more money you are wasting. It's a black hole. Throw in the money and wave it goodbye. That, in a nutshell, is fiscal Europe.

There are three ways out of this mess.

First: you somehow work yourself every hour of every day to get back in the black. With all your neighbours broke, try as you may, you aren't going to be able to sell them any more to make money to get yourself out of your own hole.

There is an interesting corollary to this. For years we have had to put up with cranks who tell us we need more kids to support us in our old age. What these half-wits haven't noticed is a few plain facts.

We have reached a point in our economic development where population rises are detrimental to our economic health, and those rises will do the exact opposite of what the misguided experts say. They will lead to falling house prices, and a falling standard of living. Let me explain.

Way back in prehistoric times human beings relied on themselves to survive. It wasn't long before they managed to get some form of tools, and those tools helped them to do more. To put that another way, the tools helped man to be more productive.

If you pick up cut grass to take back to your camp you will find you cant carry much. If you have a fork you can carry more, and therefore dont have to make so many journeys, and you become more productive. You get even more productive when you build a wheelbarrow. Once you domesticate some animals they can be enslaved and used to make you even more productive. A horse and cart carries far more than a man pushing a wheelbarrow. And so on. Throughout the ages man has by various forms of ingenuity become much more productive.

Let's come down to modern times. The industrial revolution helped productivity go through the roof, with the harnessing of water power, then electricity, with machines, production lines, and eventually robots.

I can write and send letters to several thousand people in the course of half an hour. I can record a song, and make a video during the course of a day. All this leads to two situations, which work in opposite ways.

First, let's have a look at what happened when agriculture was mechanised during the twentieth century. In 1900 about 95% of the UK working population was engaged in agriculture. A hundred years later that figure was about 3%, while at the same time considerably more food was produced. The 92% of the working population released from agriculture had other places to go to work. But then automation kicked in, then computers came along, and so on. We have reached a stage where our technical sophistication is putting more and more people on the dole, and they are going to stay there.

In primitive societies children are needed to work to provide food for the family, so the more children there are the more work can be done and the richer the group becomes.

In technologically advanced societies the exact opposite is the case. In order to be more productive and therefore richer you need less people but more machines. I run four international business from one room in my house, plus a small amount of very modern equipment. If one of those machines goes down I have a big problem, but while they are all working I can cope with a work-load that would have staggered someone living only 100 years ago.

If you look around the world you will find that countries suffering from large populations and small amounts of modern technology are poor. The countries that are relatively empty of human beings but full of modern gear will be rich.

I raise this point for one reason only. If you want to live a relatively pleasant life in a well-off community you need to move to a country where the population levels are low, and the access to modern technology is high.

I see modern day Europe gradually heading into penury because it is increasingly over-populated, and it is reaching a stage where the very technology it has is increasingly putting people out of work, and putting a bigger burden upon those who are in work to support those who are now redundant.

This situation can only grow. Futile government plans to get people back into work will not solve this problem. A government can invent work, but not make that work necessary, and so government sponsored work schemes will only make a cosmetic difference which will not last.

If you think this is all a bit off-topic for a property based site have a look at what's happening in some countries, and then look at those country's property prices.

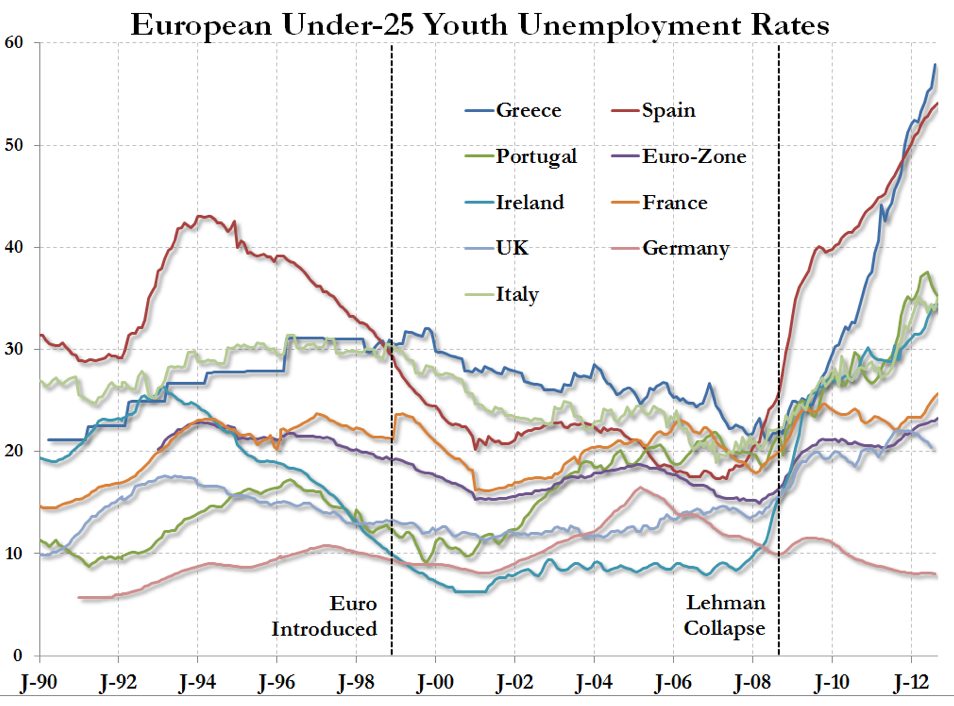

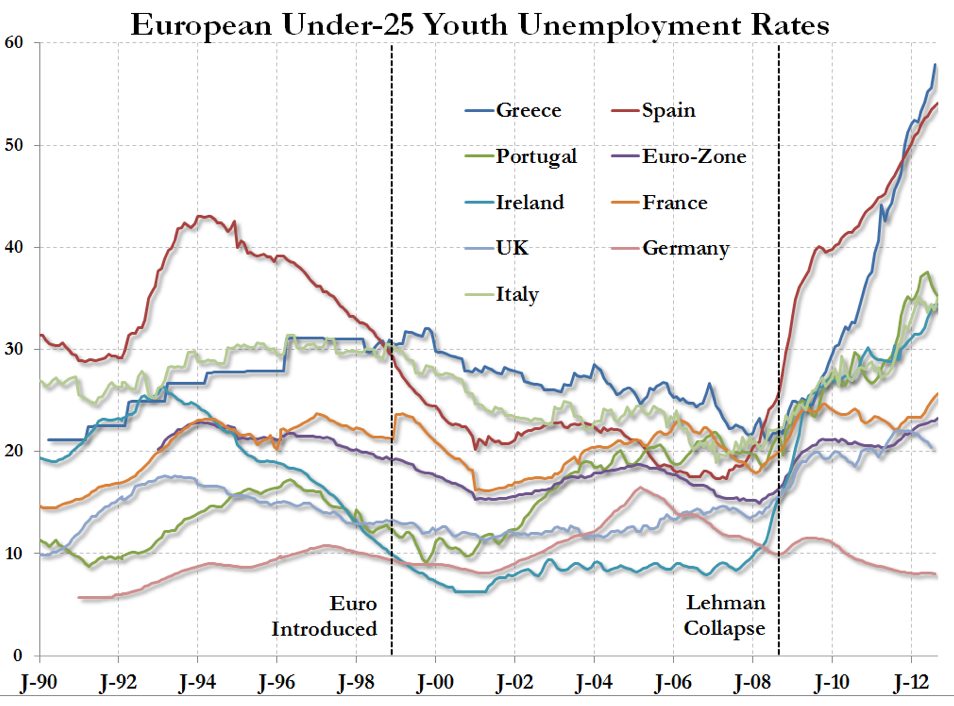

In Spain the unemployment level is around 25%. However, for the under twenty-fives that figure explodes to 55%. That's an unsupportable situation. That means half the next generation are never going to buy a house. Think about what that will do to house prices across Spain.

Now have a look at Greece. The general level of unemployment is around 30%. That in itself is an insane level for a comfortable society. However, youth unemployment is now twice that level at just over 60%. These figures are set to destroy societies not just economies.

Even Italy has a youth unemployment level of 35%. All these figures are unsupportable. If you have a third of the younger generation growing up unable to support itself that is serious indeed, yet in Spain, it's more than half a generation, and in Greece it's nearly two-thirds. You have to ask yourself where these countries will be in ten or twenty years time.

How are these jovenes as they are called in Spain going to go out and buy to get the economy moving? They wont be buying houses, furniture, washing machines, and so on. They are going to be stuck at home supported by their parents, or supported by what people are left paying tax, and the countries are going to sink back into a much lower standard of living.

That is already happening here in Portugal, with people giving up their cars, and farmers going back to using horses, and folk using bicycles, or just stopping home. More and more people are having their cars repossessed, so they can no longer in many instances get to work.

Now think what this is going to do to house prices over the longer term. In so many places the short term outlook for house prices is static to falling. The mid term is no better. But now we have a handle on what may be in the more distant future, and that doesn't look good either.

It's nice to be optimistic, but I prefer to be a realist. I have just read a company report that's landed on my desk. Let me quote just one sentence. "If the UK is in for a very rough ride, Europe is on the brink of calamity." It goes on to say "So Europe is not the place to invest."

Move south for a better climate. Move south for a slower life, maybe for retirement, but dont invest. And get used to things getting worse, with societies getting poorer.

For preference choose countries where there are fewer people. The Netherlands is a bit crowded. So is Britain. The Italian population on the other hand is contracting. Maybe that's a place to go. One thing is for certain, you need to start thinking differently from what you have previously learned, for as sure as eggs is eggs the times they are a-changing.

This is one of the reasons I feel that Italy is a better place to live than many other places in Europe, and why I shall be going on a recce of the boot of Italy and Sicily in the new year. You will have my report.

Meanwhile, I can only see the obvious with regard to Europe, and that is, there is no way out of this situation through increased work, production, etc. The continent cannot grow itself out of this fix. It needs to shrink its way out, and by that I mean shrink its population, and therefore shrink the amount of dependents there are within each state.

Second: The next obvious solution is default.

Let's go back to our neighbour with his negative equity. After a while of paying into that particular black hole our friend sees the light. He realises he will be forever paying for nothing, and one morning he wakes up to reality and says "Enough". He stops paying, and prepares to be thrown out. He defaults. He moves into rented accommodation. With any luck he pays a little less, but whatever he pays at least he is paying for something real. He is paying every month for his accommodation. He isn't paying for something he no longer has, and will never own because he is so far in arrears.

That is what should happen here in Europe. The only answer for Greece three years ago was default. It didn't happen. It still hasn't happened. God knows if it ever will happen. It is an option which is fiscally obvious, but the politicians are in control, and they dont want it to happen. It may happen despite them, but they are going to do their damnedest to prevent it, and that is why we are currently in a kind of fiscal limbo. Will they be forced into acceptance? I have no idea, but default is a very real option.

But that is just Greece, what about the other countries?

Let me answer that question by presenting you with a couple of charts. They are frightful. Just look at them and ask yourself in all honesty whether those charts show you a sane situation from which recovery is possible.

Come on guys, recovery from this is just not possible. Something has to crash.

Third: Okay, so you cant work your way out and you are prevented from default by the political system, so what's left? The usual way out in these circumstances is to print more money.

The idea is simplicity itself. You cant pay the debt so get out the John Bull Printing Outfit and print enough money to pay down that debt.

The only trouble with that idea is that as you print more money you dilute the value of the money already in circulation. As its value decreases so you need more of it to buy what you need. It's called inflation.

The money supply should increase in line with an increase in the amount of stuff which a country produces. The more you produce the more money you need to buy it. However, if you dont produce more, an increase in the money supply merely increases the cost of everything, but of course, not its value.

The argument is that a little inflation is good. It is a very persuasive argument. It allows you to buy things now on credit, and pay back over a period of years with money of reduced value. I have a house. I pay £100,000 for it. I dont actually buy it. I get a 100% mortgage with an interest payment of, say, 5%. If inflation is running at 7% then inflation is eating the value of the money by more than my cost for that money, so I am 2% better off each year. It's a great way to run a country, until everyone gets greedy and the whole thing gets totally out of hand.

At the moment we are firmly in such a situation which seems on the face of it to be jolly good. Inflation in the UK is currently 3.2%. Last year it was about 5.2%. Why should I care? I have a mortgage which costs me 1.2% over base rate. That means I am paying for my house with a mortgage interest rate of 1.7%. Since I have an interest only mortgage my purchase is costing me 1.7% a year while inflation is well above that. Two years ago my house was costing me about 3.5% less than the previous year. Now it is costing about 1.5% less than last year.

That's good for me, but not much of a deal for the bank, and it means that money is being valued less and less each year. Excuse me, but that's another way of saying inflation is with us.

What this does is to destroy savings, and if the system is left unchecked, and left to increase, it eventually leads to hyper-inflation.

If you have a mortgage you are doing fine when interest rates are low, but you get screwed when they go up.

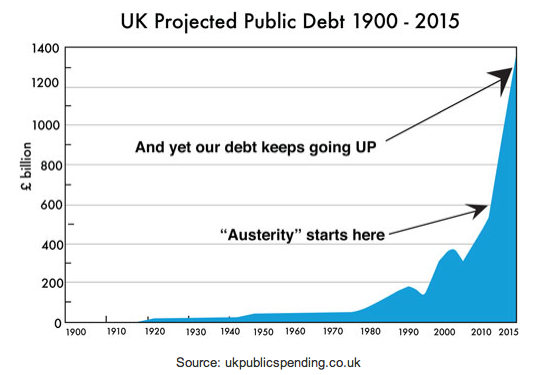

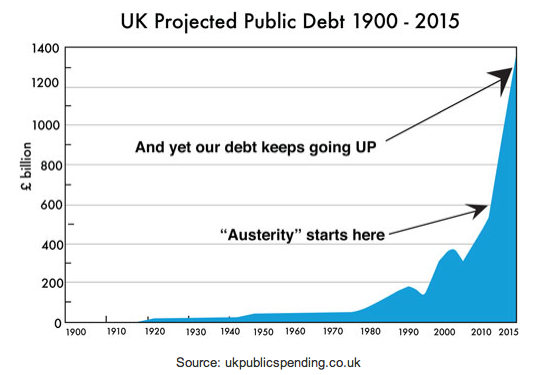

This is the time-bomb that sits under virtually every government in Europe. The UK government pays 2% for the money it borrows. The borrowing has already reached £1 trillion. If the cost of money rises so does the amount of taxes needed to pay just the interest. It doesn't take long before the government is in the situation of our distraught neighbour from our first scenario. It gets especially bad when that interest rate rises. That's when you get collapse.

When that happens you dont want to find you dont have a pension, and your house is worth half what you thought it was, but your mortgage interest is forcing you into starvation.

In this scenario you dont want to have a mortgage. You certainly dont want to have savings in the bank, building society, or some bum shares.

This is the preferred scenario of the politicians. The question we all would like an answer to is: How long before the shit hits the fan?

Some folks say 2013 is the year. Some folks say it could take another ten years. I haven't a clue, but I am beginning to get worried, and I think I want to be out of Europe altogether.

So, what is my conclusion to this second scenario?

I dont think staying in England is much of an option. I dont think staying in the Eurozone is much of an option. I think we need to get further out. I would rule out Japan, and rule out the USA. But there's a whole lot of world beyond those crisis zones.

If you have debt free property anywhere in Europe then you will be able to ride out the storm. I think you should start thinking about reducing debt. So far debt has been your friend, however, I think it is getting riskier to hold debt.

My own opinion is that you have a couple of years to re-position your assets, but I wouldn't like to bet much further out than that.

This is only scenario two of my predictions. I have to leave you to decide which of my three scenarios you prefer, but whichever you choose, you do need to have an insurance policy. That means you havqe to ring-fence your home and your income against a coming storm of inflation. This is a property related bulletin, so I can only advise here about your home. That advice is to start reducing your dependence upon a mortgage. Either reduce the amount owed, or get a mortgage with a fixed interest rate, so that you will be protected when rates rise. They may not rise for another two or three years. They may not rise for a decade. But when they do start to rise they will do so with alarming speed. You need to be prepared.

john

This is my second scenario for the new year. I am assuming that the inevitable happens: the floor collapses.

Let's face it, almost every country in the eurozone, together with the UK, is broke. That's nothing new, but what is new, is that everyone is broke together. We might as well all hold hands, sing lustily into the night, finish up the champagne, and collapse together. I shall revisit this apparently flippant situation in scenario three.

Maybe Norway is not broke. Maybe life in southern Albania is sweet, who knows? Maybe the tooth fairy will come up with something. Maybe Santa has a solution in his sack. Maybe…..

Hold on. Let's look at the facts. Ireland, Portugal, Spain, Greece, are all on a life support system. They are not only broke, but they are receiving loans from other countries which are either broke themselves, or close to it. Let's be sensible. Since when did you lend money to a down and out and expect to get it back? Since when could you expect someone who is broke to lend you money?

Reality says the money given to the PIGS wont be coming back. It is money that is going down the drain. It is wealth that is vanishing.

Let's look at another little image. Your next door neighbour is broke. He owes money on his mortgage. His house was bought for £300,000. It is now worth £200,000. He has a mortgage for £250,000 and he's two months late with the payments. What happens if you lend him money? It goes into a hole. You wont see it again, he wont see it again, and it wont ever pay off the existing debt. That debt ultimately has to be written off. The more money you throw down that debt hole the more money you are wasting. It's a black hole. Throw in the money and wave it goodbye. That, in a nutshell, is fiscal Europe.

There are three ways out of this mess.

First: you somehow work yourself every hour of every day to get back in the black. With all your neighbours broke, try as you may, you aren't going to be able to sell them any more to make money to get yourself out of your own hole.

There is an interesting corollary to this. For years we have had to put up with cranks who tell us we need more kids to support us in our old age. What these half-wits haven't noticed is a few plain facts.

We have reached a point in our economic development where population rises are detrimental to our economic health, and those rises will do the exact opposite of what the misguided experts say. They will lead to falling house prices, and a falling standard of living. Let me explain.

Way back in prehistoric times human beings relied on themselves to survive. It wasn't long before they managed to get some form of tools, and those tools helped them to do more. To put that another way, the tools helped man to be more productive.

If you pick up cut grass to take back to your camp you will find you cant carry much. If you have a fork you can carry more, and therefore dont have to make so many journeys, and you become more productive. You get even more productive when you build a wheelbarrow. Once you domesticate some animals they can be enslaved and used to make you even more productive. A horse and cart carries far more than a man pushing a wheelbarrow. And so on. Throughout the ages man has by various forms of ingenuity become much more productive.

Let's come down to modern times. The industrial revolution helped productivity go through the roof, with the harnessing of water power, then electricity, with machines, production lines, and eventually robots.

I can write and send letters to several thousand people in the course of half an hour. I can record a song, and make a video during the course of a day. All this leads to two situations, which work in opposite ways.

First, let's have a look at what happened when agriculture was mechanised during the twentieth century. In 1900 about 95% of the UK working population was engaged in agriculture. A hundred years later that figure was about 3%, while at the same time considerably more food was produced. The 92% of the working population released from agriculture had other places to go to work. But then automation kicked in, then computers came along, and so on. We have reached a stage where our technical sophistication is putting more and more people on the dole, and they are going to stay there.

In primitive societies children are needed to work to provide food for the family, so the more children there are the more work can be done and the richer the group becomes.

In technologically advanced societies the exact opposite is the case. In order to be more productive and therefore richer you need less people but more machines. I run four international business from one room in my house, plus a small amount of very modern equipment. If one of those machines goes down I have a big problem, but while they are all working I can cope with a work-load that would have staggered someone living only 100 years ago.

If you look around the world you will find that countries suffering from large populations and small amounts of modern technology are poor. The countries that are relatively empty of human beings but full of modern gear will be rich.

I raise this point for one reason only. If you want to live a relatively pleasant life in a well-off community you need to move to a country where the population levels are low, and the access to modern technology is high.

I see modern day Europe gradually heading into penury because it is increasingly over-populated, and it is reaching a stage where the very technology it has is increasingly putting people out of work, and putting a bigger burden upon those who are in work to support those who are now redundant.

This situation can only grow. Futile government plans to get people back into work will not solve this problem. A government can invent work, but not make that work necessary, and so government sponsored work schemes will only make a cosmetic difference which will not last.

If you think this is all a bit off-topic for a property based site have a look at what's happening in some countries, and then look at those country's property prices.

In Spain the unemployment level is around 25%. However, for the under twenty-fives that figure explodes to 55%. That's an unsupportable situation. That means half the next generation are never going to buy a house. Think about what that will do to house prices across Spain.

Now have a look at Greece. The general level of unemployment is around 30%. That in itself is an insane level for a comfortable society. However, youth unemployment is now twice that level at just over 60%. These figures are set to destroy societies not just economies.

Even Italy has a youth unemployment level of 35%. All these figures are unsupportable. If you have a third of the younger generation growing up unable to support itself that is serious indeed, yet in Spain, it's more than half a generation, and in Greece it's nearly two-thirds. You have to ask yourself where these countries will be in ten or twenty years time.

How are these jovenes as they are called in Spain going to go out and buy to get the economy moving? They wont be buying houses, furniture, washing machines, and so on. They are going to be stuck at home supported by their parents, or supported by what people are left paying tax, and the countries are going to sink back into a much lower standard of living.

That is already happening here in Portugal, with people giving up their cars, and farmers going back to using horses, and folk using bicycles, or just stopping home. More and more people are having their cars repossessed, so they can no longer in many instances get to work.

Now think what this is going to do to house prices over the longer term. In so many places the short term outlook for house prices is static to falling. The mid term is no better. But now we have a handle on what may be in the more distant future, and that doesn't look good either.

It's nice to be optimistic, but I prefer to be a realist. I have just read a company report that's landed on my desk. Let me quote just one sentence. "If the UK is in for a very rough ride, Europe is on the brink of calamity." It goes on to say "So Europe is not the place to invest."

Move south for a better climate. Move south for a slower life, maybe for retirement, but dont invest. And get used to things getting worse, with societies getting poorer.

For preference choose countries where there are fewer people. The Netherlands is a bit crowded. So is Britain. The Italian population on the other hand is contracting. Maybe that's a place to go. One thing is for certain, you need to start thinking differently from what you have previously learned, for as sure as eggs is eggs the times they are a-changing.

This is one of the reasons I feel that Italy is a better place to live than many other places in Europe, and why I shall be going on a recce of the boot of Italy and Sicily in the new year. You will have my report.

Meanwhile, I can only see the obvious with regard to Europe, and that is, there is no way out of this situation through increased work, production, etc. The continent cannot grow itself out of this fix. It needs to shrink its way out, and by that I mean shrink its population, and therefore shrink the amount of dependents there are within each state.

Second: The next obvious solution is default.

Let's go back to our neighbour with his negative equity. After a while of paying into that particular black hole our friend sees the light. He realises he will be forever paying for nothing, and one morning he wakes up to reality and says "Enough". He stops paying, and prepares to be thrown out. He defaults. He moves into rented accommodation. With any luck he pays a little less, but whatever he pays at least he is paying for something real. He is paying every month for his accommodation. He isn't paying for something he no longer has, and will never own because he is so far in arrears.

That is what should happen here in Europe. The only answer for Greece three years ago was default. It didn't happen. It still hasn't happened. God knows if it ever will happen. It is an option which is fiscally obvious, but the politicians are in control, and they dont want it to happen. It may happen despite them, but they are going to do their damnedest to prevent it, and that is why we are currently in a kind of fiscal limbo. Will they be forced into acceptance? I have no idea, but default is a very real option.

But that is just Greece, what about the other countries?

Let me answer that question by presenting you with a couple of charts. They are frightful. Just look at them and ask yourself in all honesty whether those charts show you a sane situation from which recovery is possible.

Come on guys, recovery from this is just not possible. Something has to crash.

Third: Okay, so you cant work your way out and you are prevented from default by the political system, so what's left? The usual way out in these circumstances is to print more money.

The idea is simplicity itself. You cant pay the debt so get out the John Bull Printing Outfit and print enough money to pay down that debt.

The only trouble with that idea is that as you print more money you dilute the value of the money already in circulation. As its value decreases so you need more of it to buy what you need. It's called inflation.

The money supply should increase in line with an increase in the amount of stuff which a country produces. The more you produce the more money you need to buy it. However, if you dont produce more, an increase in the money supply merely increases the cost of everything, but of course, not its value.

The argument is that a little inflation is good. It is a very persuasive argument. It allows you to buy things now on credit, and pay back over a period of years with money of reduced value. I have a house. I pay £100,000 for it. I dont actually buy it. I get a 100% mortgage with an interest payment of, say, 5%. If inflation is running at 7% then inflation is eating the value of the money by more than my cost for that money, so I am 2% better off each year. It's a great way to run a country, until everyone gets greedy and the whole thing gets totally out of hand.

At the moment we are firmly in such a situation which seems on the face of it to be jolly good. Inflation in the UK is currently 3.2%. Last year it was about 5.2%. Why should I care? I have a mortgage which costs me 1.2% over base rate. That means I am paying for my house with a mortgage interest rate of 1.7%. Since I have an interest only mortgage my purchase is costing me 1.7% a year while inflation is well above that. Two years ago my house was costing me about 3.5% less than the previous year. Now it is costing about 1.5% less than last year.

That's good for me, but not much of a deal for the bank, and it means that money is being valued less and less each year. Excuse me, but that's another way of saying inflation is with us.

What this does is to destroy savings, and if the system is left unchecked, and left to increase, it eventually leads to hyper-inflation.

If you have a mortgage you are doing fine when interest rates are low, but you get screwed when they go up.

This is the time-bomb that sits under virtually every government in Europe. The UK government pays 2% for the money it borrows. The borrowing has already reached £1 trillion. If the cost of money rises so does the amount of taxes needed to pay just the interest. It doesn't take long before the government is in the situation of our distraught neighbour from our first scenario. It gets especially bad when that interest rate rises. That's when you get collapse.

When that happens you dont want to find you dont have a pension, and your house is worth half what you thought it was, but your mortgage interest is forcing you into starvation.

In this scenario you dont want to have a mortgage. You certainly dont want to have savings in the bank, building society, or some bum shares.

This is the preferred scenario of the politicians. The question we all would like an answer to is: How long before the shit hits the fan?

Some folks say 2013 is the year. Some folks say it could take another ten years. I haven't a clue, but I am beginning to get worried, and I think I want to be out of Europe altogether.

So, what is my conclusion to this second scenario?

I dont think staying in England is much of an option. I dont think staying in the Eurozone is much of an option. I think we need to get further out. I would rule out Japan, and rule out the USA. But there's a whole lot of world beyond those crisis zones.

If you have debt free property anywhere in Europe then you will be able to ride out the storm. I think you should start thinking about reducing debt. So far debt has been your friend, however, I think it is getting riskier to hold debt.

My own opinion is that you have a couple of years to re-position your assets, but I wouldn't like to bet much further out than that.

This is only scenario two of my predictions. I have to leave you to decide which of my three scenarios you prefer, but whichever you choose, you do need to have an insurance policy. That means you havqe to ring-fence your home and your income against a coming storm of inflation. This is a property related bulletin, so I can only advise here about your home. That advice is to start reducing your dependence upon a mortgage. Either reduce the amount owed, or get a mortgage with a fixed interest rate, so that you will be protected when rates rise. They may not rise for another two or three years. They may not rise for a decade. But when they do start to rise they will do so with alarming speed. You need to be prepared.

john

HTML

Comment Box is loading comments...